Excerpt from Raymond James, January 3, 2020

RENEWABLE ENERGY AND CLEAN TECHNOLOGY

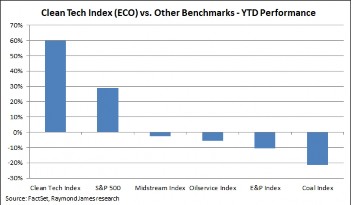

In this earnings update, we are adjusting 4Q19 and 2020 estimates for our clean tech coverage; initiating 2021 estimates; and raising six target prices (while lowering none). This past year is truly a hard act to follow. The WilderHill Clean Energy Index (ECO) posted a 2019 gain of 58%, by far the strongest performance of any energy subsector, as well as the ECO’s best performance since a 58% gain in 2013. Investor appetite and interest vis-a-vis clean tech are at the highest levels since the pre- financial crisis era.

Broadly speaking, there are two drivers for this outperformance: one fundamental and one sentiment-based. The fundamental backdrop is the global decarbonization megatrend, reflecting a potent combination of technological/ economic and political/regulatory tailwinds. In addition, there is the concurrent benefit of the ESG investing trend – one of the most visible and durable themes ….

Concrete illustrations of decarbonization run the gamut across a wide range of ….

….