Excerpt from See It Market, January 23, 2020

One of the hottest investments over the past few months has been anything related to climate change.

The WilderHill New Energy Global Innovation index (NEX) is up 28.3% since the start of October.

….

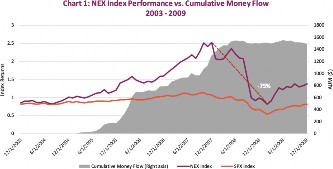

This isn’t the first time climate change investing and investments were in vogue. In 2007 the sector had a run and outperformed the broader market by more than 250% over a five-year period (Chart 1). Investors flocked to the space, pouring money into the ETF tracking the NEX index.

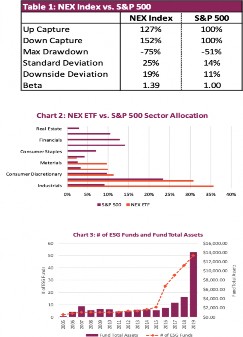

Then the great financial crisis happened and NEX fell by 75% (Table 1). Most of that money was late entering the rally, missing most of the gains and riding the index all the way down, as you can tell by the cumulative money detailed ….

…. The NEX ETF does have more inherent risk than the broad market. ….

….

Some of these ETFs are investing in genuine climate-changing investments, but some appear be more of a marketing gimmick to take advantage of the hype….

….

The much-anticipated climate crisis talked about in the early 2000s, sparking the prior rally, is no longer a theory—it is happening There’s no argument against ocean and atmospheric temperatures that continue to rise (Chart 4), despite big promises from countries around the world in the Paris Accord that was signed in ….

….

Access to capital directly impacts the weight average cost of capital (WACC) for any company. When the WACC increases for a company, the present value of future profits is lower; conversely, when the WACC falls, the present value of that cash flow increases. Put another way, when it is easy and cheap for a company to raise money, the stock is worth more; the opposite is also true.

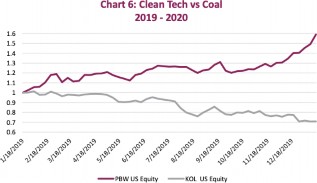

This is part of the reason we are seeing a rise in the stock price of NEX constituent companies versus the Coal ETF (Chart 6).

Demand for climate change investments is clearly on the rise from both the public and private sector, and the supply of true-impact climate investments can not keep up. While that disequilibrium is aiding the rally in the near term, it should also support future valuations. The flood of capital is motivating entrepreneurs to innovate and design truly disruptive ….

….

However, the reality today is that a sustainable business is truly difficult to pull off. The greatest flaw of the sustainable business movement is that very few participants and adherents are willing to admit that achieving sustainability is difficult, without big changes in investment strategies. It is important to be wary of the sustainable investment sector—as money floods into the space, there is not enough real product.

….

….