Excerpt from Raymond James, April 2, 2020

Industry Comment – RENEWABLE ENERGY AND CLEAN TECHNOLOGY.

Clean Tech 1Q20 Update: Mild Exposure to Oil Crash and Recession Risk, but not Immune to COVID

After arguably the most (ahem) eventful quarter most of us have ever been through, today we are providing a thorough update on what it all means for clean tech. To state the obvious, estimates and target prices are coming down, though not across the board, and certainly to a lesser degree as compared to the other energy subsectors.

….

Even as we take stock of the stunning events of the past three months, let’s also take a step back and consider the big picture: as we wrote in January, investor appetite and interest vis-a-vis clean tech are, on the whole, in very good shape.

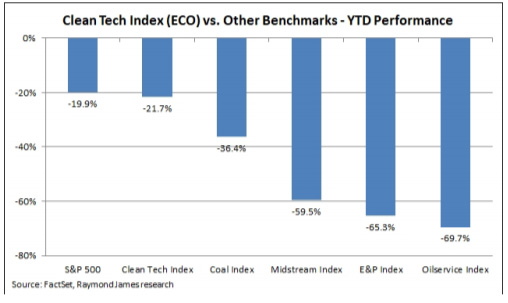

In 1Q, the benchmark ECO index fell 21% but still handily outperformed all other energy subsectors, while broadly on par with the S&P 500. The fundamental backdrop is the global decarbonization megatrend, reflecting a potent combination of technological/economic and political/regulatory tailwinds; the latter category includes, for example, the European Green Deal taking shape during 2020. In addition, there is the concurrent benefit of the ESG investing trend — one of the most visible and durable themes in the investment landscape (yes, even in times of crisis). Commodity volatility, public health challenges, and economic disruptions will not derail either of these trends over the long run.

….