Excerpt from Motley Fool, April 19, 2020

fool.com.

Whether you’re at the conservative or aggressive end of the spectrum, there’s a compelling clean-power option that’s right for you.

Maybe you’re an investor who has exited positions in oil stocks but wishes to retain exposure to the energy sector. Maybe you’re someone who recognizes the long-term trend of renewable energy options growing in popularity. Or maybe you fit into neither of these categories, yet you’re still attracted to green-power stocks.

….

While investors considering alternative power have plenty of options, in these chaotic times, one of the most pressing issues is likely to be risk threshold. With this is mind, let’s look at three renewable energy investments that will appeal to those willing to take on varying degrees of risk: Atlantica Yield …, Invesco WilderHill Clean Energy ETF, and SolarEdge Technologies ….

….

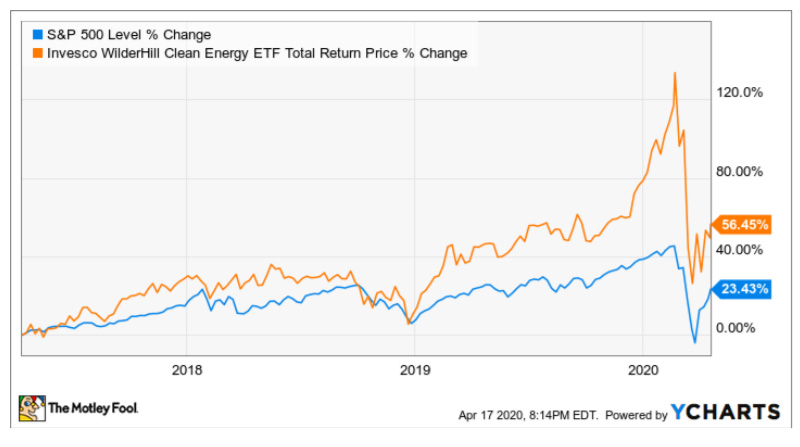

With access to a broad range of companies affiliated with renewable energy, an exchange-traded fund like the Invesco WilderHill Clean Energy ETF should appeal to investors who want minimal exposure to risk. According to Invesco, the ETF is based on the WilderHill Clean Energy Index, which “is composed of stocks of companies that are publicly traded in the United States and engaged in the business of advancement of cleaner energy and conservation.”

Mitigating the risks associated with investing in a single company, the Invesco WilderHill Clean Energy ETF follows a conservative route to investing in some of the leading renewable energy companies, like Tesla (the ETF’s largest current holding), solar panel manufacturer First Solar, and lithium producer Livent to name a few. Although the expense ratio of 0.70% may seem high, the ETF’s distributions offset this as they represent a trailing-12-month yield of 2.28%.

Over the past three years, the ETF has outperformed the S&P 500, illustrating the growing acceptance of renewable energy in the marketplace. And the trend will likely continue in the years to come for various reasons. For example, local municipalities, states, and nations striving to meet renewable portfolio standards represent significant tailwinds, while homeowners choosing to source their power needs from solar solutions and drivers opting for electric vehicles represent other factors.